- How quickly can I qualify?

- Which rules could get me disqualified?

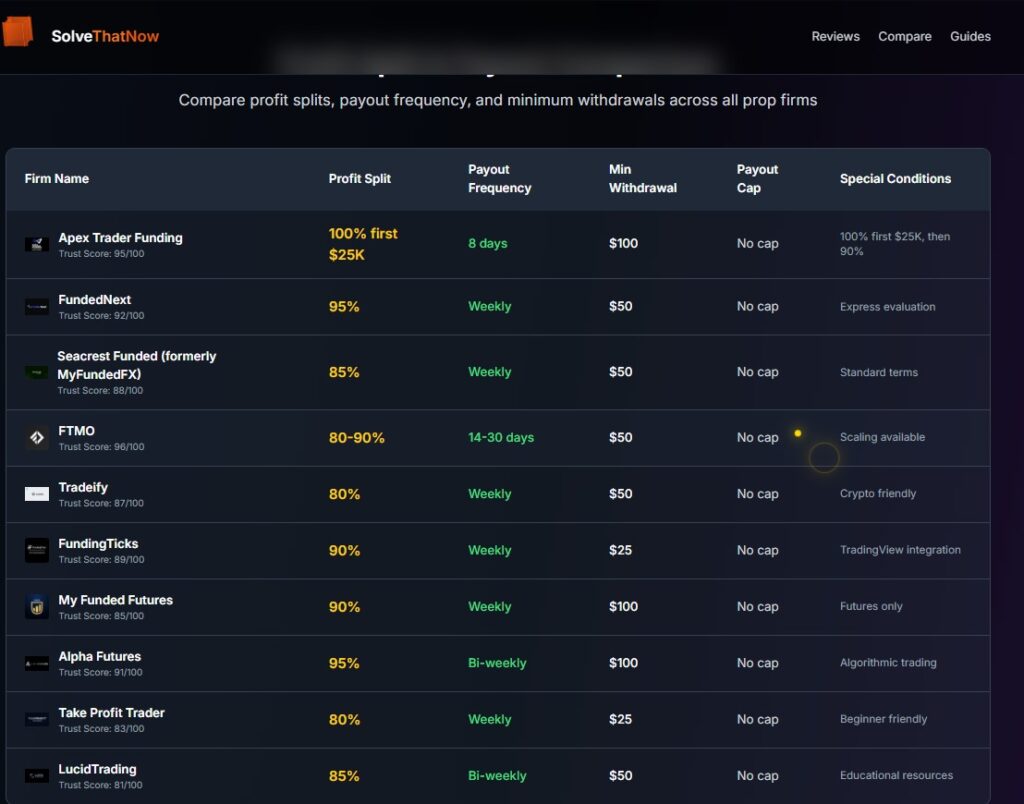

- What does payout look like—profit split, frequency, caps?

- What’s the true cost (fees, resets, platform/data)?

- Will this firm support the way I actually trade?

- Main hub: https://solvethatnow.com/compare-prop-firms

- Reviews: https://solvethatnow.com/compare-prop-firms#reviews

- Guides: https://solvethatnow.com/compare-prop-firms#guides

- Calculators: https://solvethatnow.com/calculators

- One‑phase vs two‑phase challenges: fewer phases can mean faster qualification, but rules may tighten elsewhere.

- Minimum trading days: if you’re a low‑frequency swing trader, confirm activity requirements.

- Time limits: some firms allow no time limit; others are strict.

- Daily loss and max drawdown disqualify more traders than anything else.

- Static vs trailing drawdown; end‑of‑day (EOD) vs intraday matters a lot for futures.

- Consistency rules: if you size unevenly or take sparse A‑setups, check expectations before you begin.

- Profit splits commonly range from 80–95%.

- Payout cadence can be weekly, bi‑weekly, or 14–30 days.

- Verify minimum withdrawals and any payout caps.

- Forex, futures, crypto, indices—confirm your instruments and data.

- TradingView, MT4/5, NinjaTrader, or API access for systematic traders.

- Platform/data fees and any hidden costs.

- Challenge + activation + platform/data fees.

- Reset or retake costs if you barely miss a rule.

- Promo pricing helps, but don’t anchor your decision on it.

- FTMO — reputation, stability, and a mature program. Balanced evaluation, strong support, and scaling opportunities. Deep dive: https://solvethatnow.com/prop-firms/ftmo

- Seacrest Funded (formerly MyFundedFX) — flexible rules for traders who need breathing room. FAQs, rules, and details: https://solvethatnow.com/prop-firms/myfundedfx

- Alpha Futures — strong for technically inclined/systematic traders who value API access and analytics. Overview: https://solvethatnow.com/prop-firms/alpha-futures

- Scalpers: Look for clarity on intraday trailing drawdown, permission around news trading, and faster payout cadence.

- Swing traders: Favor EOD drawdown, overnight/weekend holds, and fewer “consistency” constraints.

- Systematic/quant: Platform stability, reliable data, and API access become non‑negotiable.

- Hidden news restrictions: confirm whether news trading is allowed or not.

- Overnight/weekend holds: if you swing trade, ensure these are acceptable.

- Daily loss vs max drawdown: know both numbers cold—set platform‑level risk controls.

- Profit projection, position sizing, drawdown tolerance, and payout cadence implications.

- Tools: https://solvethatnow.com/calculators

- Reviews: https://solvethatnow.com/compare-prop-firms#reviews

- FTMO: https://solvethatnow.com/prop-firms/ftmo

- Seacrest Funded (formerly MyFundedFX): https://solvethatnow.com/prop-firms/myfundedfx

- Alpha Futures: https://solvethatnow.com/prop-firms/alpha-futures